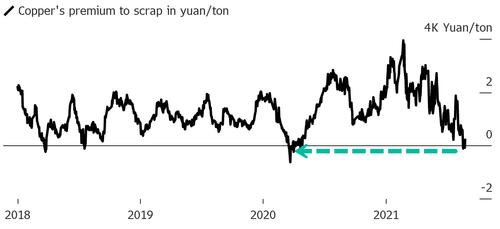

On Thursday (Aug. 26), copper prices and other industrial metals retreated overnight as the dollar rallied ahead of the annual meeting of global central banks in Jackson Hole, ending a rally earlier in the week. However, the re-emergence of a rare phenomenon in the commodity futures market after more than a year is causing some copper bulls to smell a potential opportunity - refined copper prices are once again below scrap prices.

Colin Hamilton, managing director of commodities research at BMO, said this week that buyers appear to have re-entered the market after months of a pullback correction in copper prices. He noted that at the end of last week spot prices for high-grade copper scrap in China were already higher than refined copper prices. This is a strong indication that copper scrap supply is rapidly diminishing.

The last time this happened was back in April last year, when central banks and governments around the world injected trillions of dollars of stimulus money into the economy. LME copper futures bottomed out in the first quarter of the year and surged, breaking the $10,000 mark in May and setting a new record high of $10,747.

Hamilton pointed out that the rising price of copper scrap and the lack of supply has shifted some demand to direct purchases of refined copper, which could push up the latter's price.

According to Colin Hamilton, "This move is clearly unusual, and while it doesn't make much sense on an economic level, it is a sign that the market sell-off may have gone beyond the fundamentals themselves. We do see some initial signs that Chinese buyers have stopped de-stocking and are returning to the market."

Despite the pullback in copper prices over the past few months, LME copper futures prices have risen 126% since the low point of the epidemic last year, and the overall upward trend has not completely shifted.

Copper prices firm up after the market.

Copper is used in the power and construction sectors. Many analysts expect copper demand to be very strong as fossil fuels are replaced by electrification. In fact, in addition to the rare inversion between scrap and refined copper prices mentioned above, there is no shortage of signs of bullishness about the future prospects of copper prices in a number of other areas right now.

China's Yangshan copper import premium has recently risen to more than $100 per tonne from $21 per tonne in June, indicating stronger demand for the overseas metal in the Chinese market, which has historically been the world's largest buyer of copper in the physical market.

In addition, copper stocks at LME-registered warehouses have fallen to 178,125 tonnes from nearly 240,000 tonnes a week ago, and LME spot copper spreads against the three-month contract have risen to a premium from a discount of about $30 in mid-August, indicating a tightening of supply of the metal for quick delivery.

Contact: Manager Gao

Phone: +86-15932423630

Tel: +86-311-89276065

Email: sales@ht-wiremesh.com

Add: Wire Mesh Zone,Anping County,Hebei Province,China.